Introduction

In today’s highly competitive brokerage landscape, professional traders seek partners that combine strong regulatory backing, robust technology, and transparent trading conditions. ADSS, formally known as ADS Securities LLC – S.P.C, presents itself as one such broker. Positioned in the Middle East with international reach, the company offers contracts for difference (CFDs), foreign exchange, indices, commodities, equities, exchange-traded funds, and cryptocurrencies.

Regulatory Background and Corporate Profile

ADSS operates under the legal framework of the United Arab Emirates. The broker is authorised and regulated by the Securities and Commodities Authority (SCA), the main financial regulator in the UAE. This authorisation provides oversight of client funds, trading practices, and the overall operational standards of the firm. Additionally, ADSS is registered with the Department of Economic Development of Abu Dhabi, underlining its corporate legitimacy in the region.

The company’s identity is sometimes interchanged with ADS Securities, a name still widely recognised in industry comparisons. Both designations typically refer to the same corporate group, with ADSS acting as the principal trading brand.

Scope and Market Access

From its headquarters in Abu Dhabi, ADSS offers global and regional access to a wide spectrum of financial markets. Clients can trade major, minor, and exotic currency pairs, as well as CFDs on equities, commodities, indices, and exchange-traded funds. For traders seeking exposure to digital assets, the broker provides CFDs on leading cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and Bitcoin Cash, tradable around the clock from Monday to Friday.

The multi-asset structure allows for portfolio diversification, risk hedging, and strategy design across asset classes. This positioning makes ADSS suitable for professionals who prefer consolidated access to different markets through a single broker.

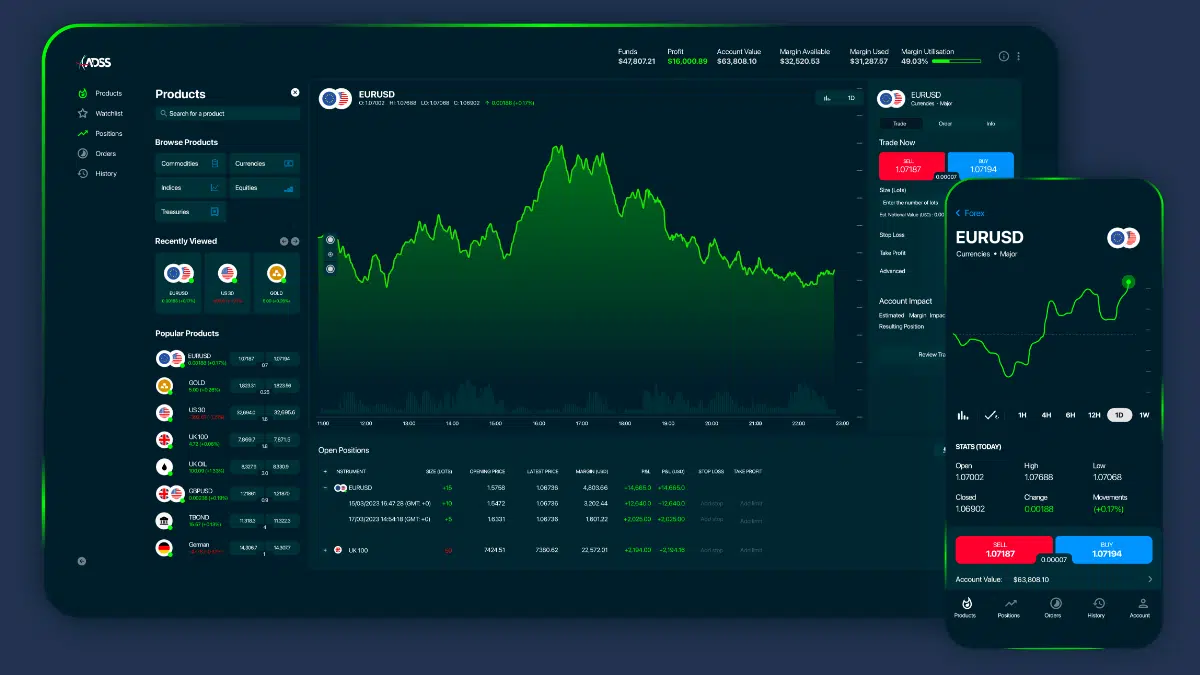

Trading Platforms and Tools

ADSS integrates both proprietary and third-party platforms to meet different trading styles. Its in-house platform features advanced charting capabilities, technical indicators, and risk-management modules designed to support decision-making. The platform also accommodates various order types, including stop and limit orders, which are essential for active risk control.

For traders already accustomed to MetaTrader 4 (MT4), ADSS provides full MT4 support. MT4 remains one of the most widely used platforms globally, with an established ecosystem of expert advisors, scripts, and analytical tools. This dual-platform approach ensures that both discretionary and algorithmic traders can operate comfortably within the ADSS environment.

Account Types and Support Structure

ADSS categorises its accounts into Classic, Elite, and Pro tiers. Each tier is structured to meet the requirements of different trader profiles:

- Classic Account: Designed for standard retail or smaller-volume traders, providing access to core features and market instruments.

- Elite Account: Offers enhanced features such as tighter spreads and access to dedicated relationship managers.

- Pro Account: Tailored for high-volume professional traders, often including direct contact with the markets desk or sales trader support.

To accommodate new users or those testing strategies, ADSS provides demo accounts that replicate live trading conditions without capital risk. This option is valuable for both training and system development.

Customer service is available 24/5, with priority support offered to higher-tier account holders. For professional traders, direct and knowledgeable support can be an important differentiator.

Leverage, Spreads, and Execution

Leverage is a defining element of the ADSS offering. On major forex pairs, leverage can reach up to 500:1, while commodities, indices, and equities generally feature lower but still competitive leverage. Such ratios enable efficient use of capital but simultaneously introduce heightened risk, requiring strict risk management.

Spreads are presented as competitive, starting from 0.7 pips on certain forex pairs and precious metals, depending on account type. Execution quality is emphasised through the inclusion of multiple order types and margin monitoring tools. For high-frequency or intraday strategies, these features support precision and scalability.

Market Segments in Detail

Forex

ADSS provides a broad range of currency pairs, from liquid majors like EUR/USD to less-traded exotics. The high leverage offering in forex reflects its role as the broker’s flagship market.

Commodities

Professional traders can access CFDs on energy products, agricultural contracts, and metals. With integrated charting and analytics, commodities can be traded for both hedging and speculative purposes.

Indices

CFDs on global indices are available with leverage up to 500:1. These instruments enable broad exposure to regional or global equity markets through a single contract.

Cryptocurrencies

Digital asset CFDs are available on a 24/5 basis, offering a regulated entry point into this volatile market segment.

Equities and ETFs

ADSS allows CFD trading on equities and ETFs, subject to exchange trading hours and lower leverage thresholds compared to forex and indices.

Educational Resources and Market Information

The broker complements its trading services with educational and informational resources. Traders gain access to video tutorials, platform guides, technical analysis, and glossaries. Regular market commentary helps professionals monitor global developments while aligning strategies with real-time insights. ADSS also maintains a repository of legal and policy documents to ensure transparency regarding client terms, charges, and margin requirements.

Strengths for Professional Traders

Several aspects stand out as key advantages for professionals:

- Regulation in the UAE: Authorisation by the SCA provides a degree of oversight relevant for regional and international clients.

- Diverse Asset Offering: A multi-asset environment supports hedging and portfolio diversification.

- Competitive Leverage and Pricing: High leverage and low spreads enhance capital efficiency.

- Platform Choice: Both proprietary and MT4 platforms cater to different trading styles.

- Tiered Accounts with Enhanced Support: Dedicated relationship managers and market desks can improve execution and service for elite and professional clients.

- Transparency: Public access to client agreements, fee schedules, and margin rules supports informed decision-making.

Suitability for Different Trading Strategies

ADSS appears suitable for several professional use-cases:

- High-Frequency and Intraday Trading: Tight spreads and fast execution support active strategies, although liquidity may vary outside core hours.

- Portfolio Diversification: Multi-asset access facilitates cross-market exposure but requires attention to differing leverage and cost structures.

- Hedging: CFDs allow short positioning and hedging of external exposures, subject to rollover and margin considerations.

- Long-Term Leverage Exposure: Leverage can enhance directional positions, but overnight financing costs may erode returns if held for extended periods.

Final Assessment

ADSS, operating under the regulatory oversight of the UAE’s Securities and Commodities Authority, offers a broad range of markets and a flexible account structure aimed at both individual professionals and institutional traders. Its platform options, competitive leverage, and multi-asset access position it as a comprehensive broker for those seeking both regional and international market participation.