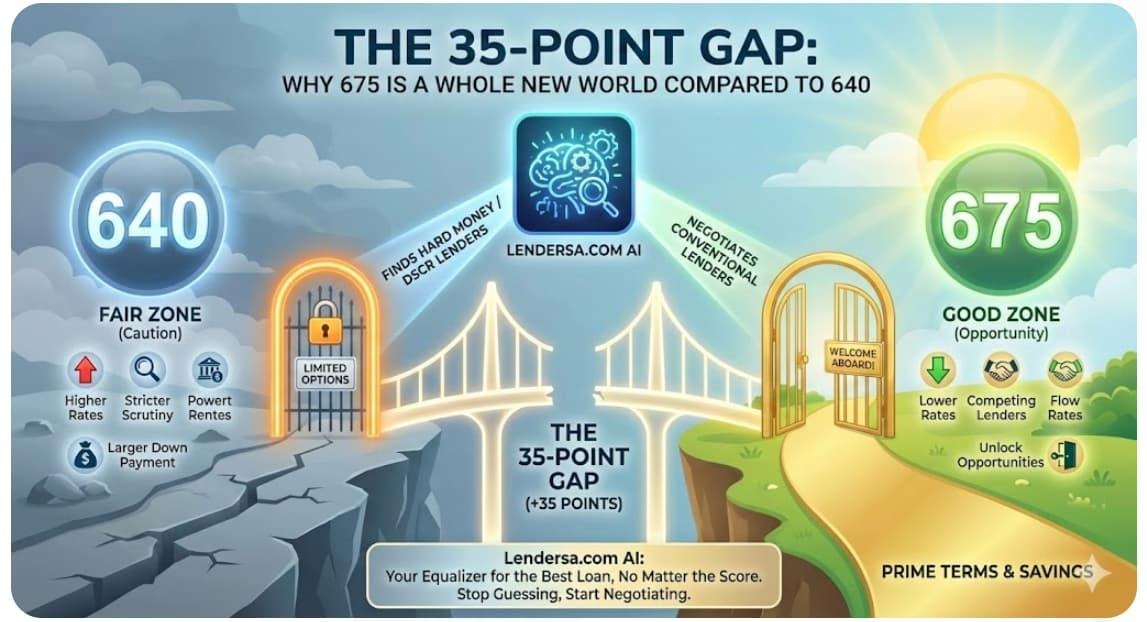

The 35-Point Gap: Why a Credit Score of 675 is a Whole New World Compared to 640

In the world of finance, numbers can feel like abstract concepts—until you try to buy a house or get a loan. Then, suddenly, those three little digits define your entire financial reality.

Most people think credit scores are a smooth slope, where a few points here or there don’t matter much. But the truth? It’s more like a staircase. And the step between a credit score 640 and a credit score 675 is a doozy.

That tiny 35-point difference is effectively the Grand Canyon of lending. It is often the dividing line between “We’ll have to think about it” and “Welcome aboard!”

The Tale of Two Scores

Let’s break down what lenders actually see when they look at these two numbers.

- Credit Score 640 (The “Fair” Zone): A 640 is respectable—you aren’t in the subprime basement. However, in the eyes of many conventional lenders, you are “on the bubble.” You might get approved, but you’ll likely face higher interest rates, stricter scrutiny, and larger down payment requirements.

- Credit Score 675 (The “Good” Zone): Crossing into 675 territory typically graduates you from “Fair” to “Good” (or “Prime” depending on the model). Suddenly, doors unlock. Interest rates drop, insurance premiums decrease, and lenders start competing for your business rather than you begging for theirs.

Why 35 Points Changes Everything

The magic of the credit score 675 versus the credit score 640 lies in “risk tiers.”

For a conventional mortgage, a 640 might trigger a requirement for higher Private Mortgage Insurance (PMI), costing you hundreds more per month. At 675, that PMI premium usually shrinks. Over the life of a 30-year loan, that 35-point difference could save you enough money to buy a decent new car—or at least a very nice vacation every year.

But what if you don’t have time to fix your credit? What if you need a loan now, whether you are sitting at a 640 or a 675?

Enter the Equalizer: Lendersa.com AI

This is where the game changes. In the past, if you had a credit score 640, you were at the mercy of whatever local bank would talk to you. Now, technology has flipped the script.

Lendersa.com utilizes advanced AI to democratize lending. It doesn’t just look at your credit score and shrug; it actively hunts for the best possible match across a massive network.

How Lendersa.com AI Works for You

Whether you are an investor looking for leverage or a homebuyer looking for a break, Lendersa’s AI acts as your personal negotiator. It scans thousands of options to find lenders who specialize in your specific financial profile.

- Hard Money Lenders: Need cash fast for a flip? The AI identifies private lenders who care more about the asset’s value than the credit score difference between 640 and 675.

- DSCR Lenders: This is a secret weapon for investors. DSCR (Debt Service Coverage Ratio) lenders don’t look at your personal income; they look at the property’s cash flow. If the rent covers the mortgage, you can often get approved regardless of whether you have a credit score 640 or higher.

- Conventional Lenders: If you do have that shiny credit score 675, the AI forces lenders to compete, driving your rate down even further.

Stop Guessing, Start Negotiating

The beauty of Lendersa.com is that it removes the fear of rejection. Instead of walking into a bank and hoping for the best, the AI instantly sorts through the noise. It compares terms and negotiates on your behalf to ensure you get the best deal available for your specific tier.

Whether you are trying to climb out of the 640s or capitalizing on your 675 status, you don’t have to navigate the lending minefield alone. Let the AI do the heavy lifting, so you can focus on what matters: getting the keys to your new property.