Managing sudden expenses or fulfilling short-term financial goals often requires quick access to funds. A personal loan of Rs. 1 lakh can be a practical solution for covering needs such as medical bills, travel plans, education expenses, gadget purchases, or small home improvements. With easy digital processes and flexible repayment options, such loans help you stay financially prepared without disturbing your monthly budget.

Understanding eligibility, EMI structure, and interest costs before applying allows you to borrow responsibly. This guide explains everything you need to know, helping you make informed decisions and plan repayments with confidence.

What does a personal loan of Rs. 1 lakh mean?

A personal loan of Rs. 1 lakh is a small-ticket, unsecured loan that does not require any collateral. It is designed for short-term financial needs and is usually repaid through fixed monthly instalments over a chosen tenure. Since there is no security involved, lenders evaluate your income, employment stability, and credit history before approving the loan.

Such loans are popular because of their flexibility. You can use the funds for almost any personal purpose, making them a reliable financial backup during emergencies or planned expenses.

Who is eligible for a personal loan of Rs. 1 lakh?

Eligibility criteria may vary slightly among lenders, but the basic requirements remain similar. Most lenders look for the following factors:

- Nationality: Indian

- Age: 21 years to 80 years*.

- Employed with: Public, private, or MNC.

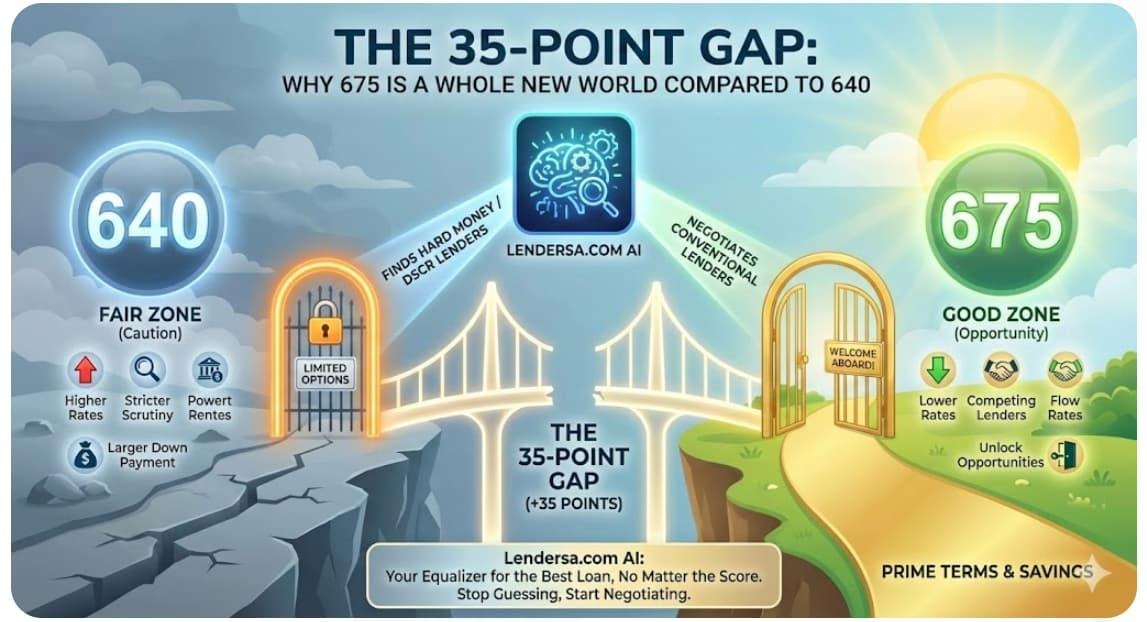

- CIBIL Score: 650 or higher.

- Customer profile: Self-employed or Salaried

*You must be 80 years * or younger, at the end of the loan tenure.

Meeting these conditions improves your chances of approval and helps you secure better interest rates. A healthy financial profile ensures smoother processing and quicker disbursal.

Documents usually required

The documentation process for a personal loan of Rs. 1 lakh is simple and quick. Typically, you need:

- KYC documents: Aadhaar/ passport/ voter’s ID/ driving license/ Letter of National Population Register/ NREGA job card

- PAN card

- Employee ID card

- Salary slips of the last 3 months

- Bank account statements of the previous 3 months

- Piped gas bill

- Pension order

- Letter of Allotment of Accommodation Issued by Employer

- Property / Municipal tax receipt

- Utility bill

- Phone bill

- Real-time image / photograph

Digital applications often reduce paperwork, making the process faster and more convenient.

Understanding EMI for a personal loan of Rs. 1 lakh

Your EMI depends mainly on the loan tenure and interest rate. A shorter tenure leads to higher EMIs but lower overall interest, while a longer tenure reduces monthly burden but increases total repayment.

For example, if you borrow Rs. 1 lakh for 12 months at a moderate interest rate, your EMI may range between Rs. 8,500 and Rs. 9,000. For a 24-month tenure, it could drop to around Rs. 4,500 to Rs. 5,000. These figures vary based on the lender’s policies and your credit profile.

Choosing the right tenure helps you maintain financial balance and avoid unnecessary strain on your monthly budget.

Interest cost explained in simple terms

Interest cost refers to the additional amount you pay over and above the principal loan amount. For a personal loan of Rs. 1 lakh, this depends on the interest rate and tenure you select.

If you opt for a shorter tenure, the total interest paid is lower, making the loan more economical. On the other hand, longer tenures may seem easier on the pocket due to smaller EMIs but result in higher interest costs over time. This is why balancing EMI comfort and total repayment is important.

When does an instant personal loan become useful?

There are situations when quick access to funds becomes essential. An instant personal loan proves helpful during medical emergencies, urgent travel, sudden home repairs, or last-minute educational needs. Since approvals and disbursals are fast, borrowers can manage time-sensitive expenses without delays.

This option offers convenience, especially when savings are limited or when you prefer not to disturb long-term investments. However, quick borrowing should always be accompanied by careful repayment planning.

How to calculate EMI and interest easily

Online EMI calculators allow you to estimate your monthly repayments within seconds. By entering the loan amount, interest rate, and tenure, you can instantly view your EMI and total interest payable.

Using such tools helps you compare different tenures and choose the one that suits your financial comfort. It also prevents guesswork and supports smart budgeting.

Benefits of choosing a Rs. 1 lakh personal loan

A personal loan of Rs. 1 lakh offers multiple advantages:

- Quick access to funds

- No collateral requirement

- Flexible repayment tenures

- Simple documentation

- Easy digital application

These benefits make it a practical borrowing option for short-term financial needs.

Common mistakes to avoid while taking a small personal loan

Even small loans require careful planning. Some common mistakes include borrowing more than required, choosing very short tenures leading to high EMIs, and ignoring interest costs. Failing to read loan terms carefully can also result in hidden charges or penalties.

Avoiding these mistakes ensures a smooth borrowing experience and keeps your finances stress-free.

Smart tips to reduce interest burden

To minimise interest costs, always maintain a good credit score, repay existing dues on time, and choose the shortest affordable tenure. Comparing loan offers and using EMI calculators can also help you find the most economical option.

Final thoughts

A personal loan of Rs. 1 lakh can be a reliable financial solution when planned wisely. By understanding eligibility, EMI structure, and interest costs, you can borrow responsibly and manage repayments comfortably. Whether it is for emergencies, personal goals, or short-term needs, smart planning ensures that your loan supports your lifestyle without causing financial pressure.

With informed decisions and disciplined repayment, a personal loan becomes not just borrowed money, but a tool to handle life’s important moments with confidence and ease.