In recent years, the advent of trading apps has significantly transformed the stock market landscape, making it more accessible and user-friendly for investors of all levels. If you’re looking to capitalize on these benefits, one of the first steps is to open demat account through a reliable trading app. This article explores how trading apps are revolutionizing the stock market experience and why you should consider integrating them into your investment strategy.

Accessibility and Convenience

Trading apps have made stock market investing incredibly accessible. Gone are the days when you needed to visit a brokerage firm or make phone calls to place trades. Now, with just a few taps on your smartphone, you can open demat account and start trading instantly. These apps offer a seamless experience, allowing you to monitor your portfolio, execute trades, and stay updated with market trends anytime and anywhere.

User-Friendly Interfaces

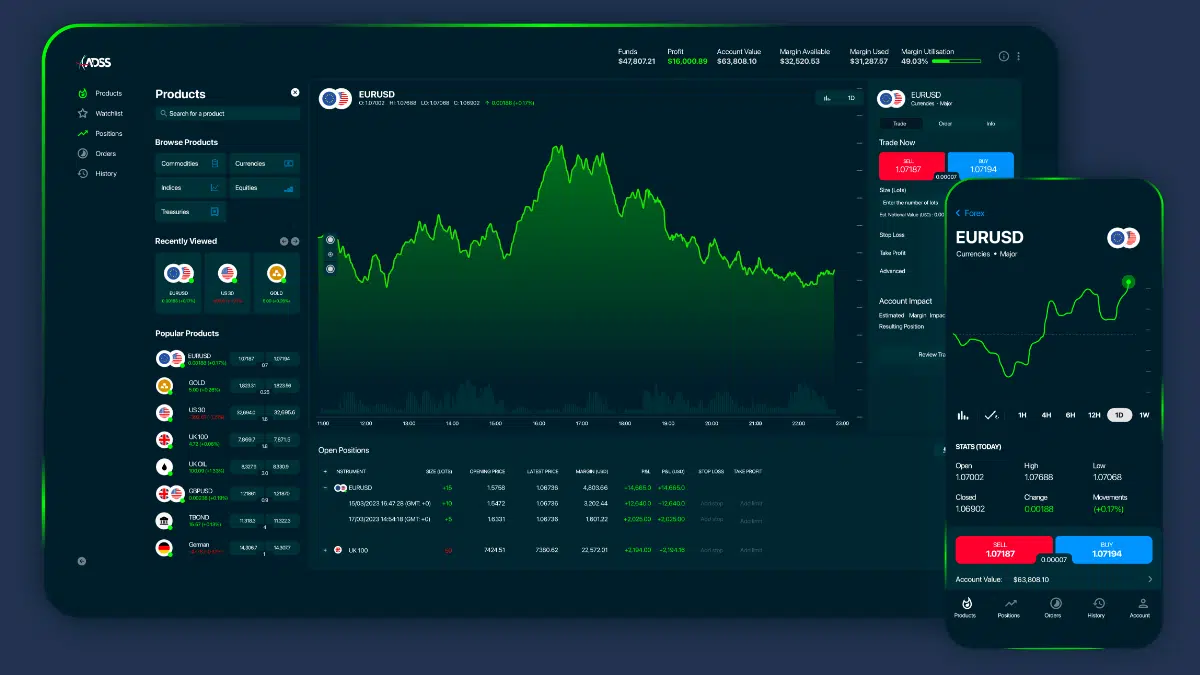

One of the significant advantages of trading apps is their user-friendly interfaces. Designed to cater to both novice and experienced investors, these apps simplify the complexities of stock trading. When you open demat account through a trading app, you gain access to intuitive dashboards that display your investments, real-time market data, and analytical tools. This ease of use ensures that even those new to trading can navigate the stock market with confidence.

Cost-Effective Trading

Traditional brokerage services often come with high fees and commissions, which can eat into your investment returns. However, trading apps typically offer lower fees, making it more cost-effective to open demat account and trade. Many apps also provide commission-free trading options for certain stocks and ETFs, further reducing the cost of investing and maximizing your profits.

Educational Resources

To help users make informed decisions, trading apps often come equipped with a wealth of educational resources. When you open demat account, you gain access to tutorials, webinars, and articles that cover a range of investment topics. These resources are invaluable for beginners looking to build their knowledge and confidence in stock trading.

Security and Regulation

Security is a paramount concern for any investor, and trading apps prioritize the protection of user data and funds. When you open demat account through a reputable trading app, you benefit from robust security measures, including encryption, two-factor authentication, and regulatory compliance. This ensures that your investments and personal information remain secure.

Integration with Financial Tools

Modern trading apps often integrate with other financial tools, providing a holistic approach to managing your finances. By opening a demat account, you can link your trading app with banking apps, budgeting tools, and tax software, streamlining your financial management. This integration helps you maintain a comprehensive view of your financial health, enabling more strategic investment decisions.

Community and Social Features

Many trading apps incorporate social features, allowing users to connect with other investors, share insights, and discuss market trends. After you open demat account, you can join these communities to learn from others’ experiences and gain different perspectives on investment strategies. This social aspect fosters a collaborative environment that can enhance your trading experience.

Conclusion

Trading apps have undeniably revolutionized the stock market experience, making it more accessible, efficient, and user-friendly. By choosing to open demat account through a trading app, you can take advantage of real-time data, cost-effective trading, educational resources, and enhanced security.